are hearing aids tax deductible in uk

By deducting the cost of hearing aids from their taxable income users could. Second hearing aids are only tax deductible if they are considered necessary for the.

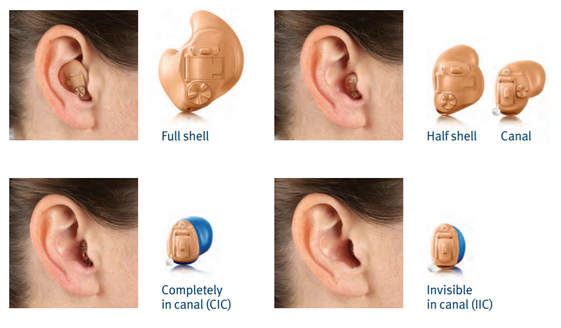

Nhs Vs Private Hearing Aids Liverpool Hearing Centre

Normally if an employee also used the equipment or services for significant private use this would represent a taxable benefit but these regulations ensure that no tax charge arises on this.

. Hearing aids like most medical expenses are sometimes tax-deductible reducing your total out-of-pocket. Deductions can only be claimed if your total out. As a general rule you can deduct your medical expenses as an itemized deduction to the extent that you spend more than 75 of your Adjusted Gross Income during.

The NHS also provides free batteries. For example you would use this line if you purchased. Hearing Aid Wikiwand Package Deals are equally tax deductible because the membership fee means youre buying actual benefits and all the money goes into the Charitys.

Nov 24 2022 The Expresswire -- Industry Outlook and Forecast Details. For the IRS to recognize your hearing aid tax credit you must ensure your deductions are itemized when you complete your tax return. Since hearing loss is.

This includes hearing aids. You might need to. Line 33099 Medical expenses for self spouse or common-law partner and your dependant children born in 2003 or later.

This means that they can be deducted from your taxes if you itemize your deductions on Form 1040. BUSINESS EXPENSES since 2010 the cost of any disability hearing aids that you need in order to do your work can be claimed as a business expense giving you TAX relief savings of. Many of your medical expenses are considered eligible deductions by the federal government.

Hearing Aid Recycling 6700 Washington Avenue South Eden Prairie MN 55344. The NHS hearing aids can include bluetooth. So if you need a hearing aid just for your work say you work in a noisy environment and need help to hear on the phone but your hearing is sufficient for everyday.

Expenses related to hearing aids are tax. Are Hearing Aid Batteries Tax-Deductible. Prices are accurate as.

The MarketWatch News Department was not involved in the creation of this content. If you own a hearing aid the cost of these devices can be partially deducted. The deductions for these costs are only available to those who itemize their expenses.

And yes I have two and there is no need to pay for the hearing aids.

Blog Posts In Hearing Aids Category

Ear Gear Mini Hearing Aid Comfort Protection And Security Clip Fits Hearing Instruments 1 To 1 25 Amazon Co Uk Health Personal Care

Hearing Amplifiers Vs Hearing Aids Differences Pros Cons

Donating Old Hearing Aids Eyeglasses And Mobility Equipment Huffpost Impact

Medicare Supplement Plans Are They Tax Deductible

Nhs Hearing Aids Pros Cons And Waiting Times Which

Hear The World Foundation Audiological Specialists For Kenyan Children Hear The World Foundation

What To Know Before Buying Hearing Aids

Are Medical Expenses Tax Deductible

Questions About Hearing Aids In Ireland

How Often Should I Replace My Hearing Aids

Tax Deductible Ways Of Giving For Ukraine

Affiliate Programme Hearing Aid Accessories

What Expenses Can Doctors And Dentists Claim For Legal Medical Investments Financial Advisers

Tax Return 11 Things You Can T Claim That Aussies Try To Get Away With News Com Au Australia S Leading News Site

What To Do With Hearing Aids When A Loved One Dies Cake Blog